So, without further ado, let’s examine how to find out which form applies to you! Table of Contents

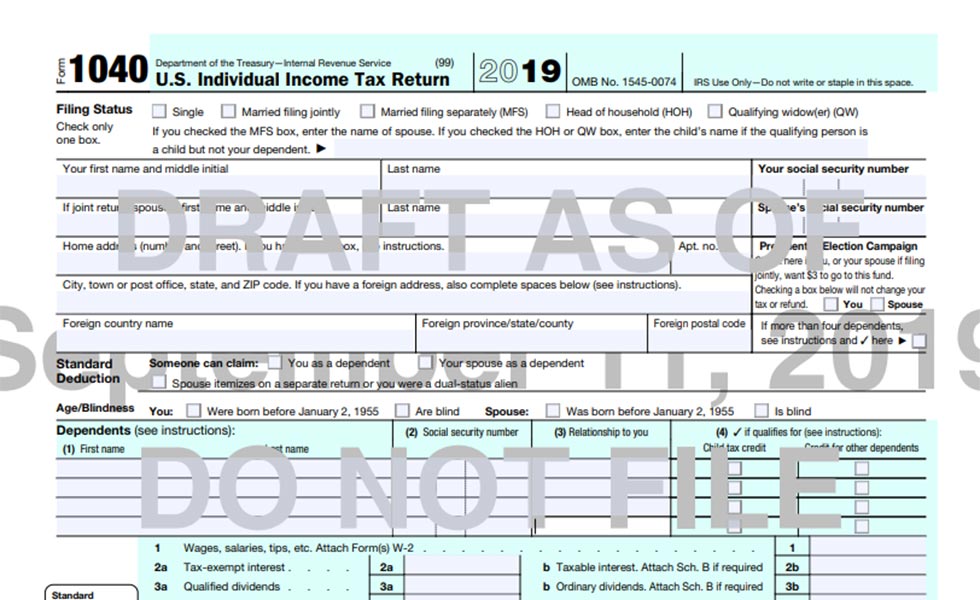

In this blog post, we’ll be discussing Forms 1040, 1040NR, 1040NR-EZ, and how they apply to each person’s situation.įorm 1040 (NR & NR-EZ) figures out the total taxable income of the taxpayer and determines how much of a refund the person may be due. One of the more common difficulties nonresidents face is filing their tax return. Form 1040NR has been simplified and will be used instead.Ĭoming to the US from a foreign country presents both thrills and challenges to every nonresident. Still have questions? Check out our FAQ here.Important: Since 2020, the IRS no longer uses form 1040-NR-EZ. It will not be available in your unemployment dashboard.

If we have your email address on file, we will send you via email the information for your 1099-G for 2022.Similarly, if you are paid for 2022 weeks in 2023, those will not be on your 1099-G for 2022 – they will appear on your 1099-G for 2023. Meaning, if you were paid in 2022 for weeks of unemployment benefits from 2021, those will appear on your 1099-G for 2022. Please note that your 1099-G reflects the total amount paid to you in 2022, regardless of the week that payment represents.Please refer to the section titled “Repayments” in the IRS Publication 525 Taxable and Nontaxable Income for guidance on how to report overpayments/returned funds. If you were overpaid benefits, your 1099-G will still reflect, per federal law, the amount of funds paid to you, regardless of any funds you have returned.Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 60. Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments for the tax year on the notice, you may be the victim of identity theft.

This information is also sent to the IRS. After each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld.

0 kommentar(er)

0 kommentar(er)